- updated: April 30, 2021

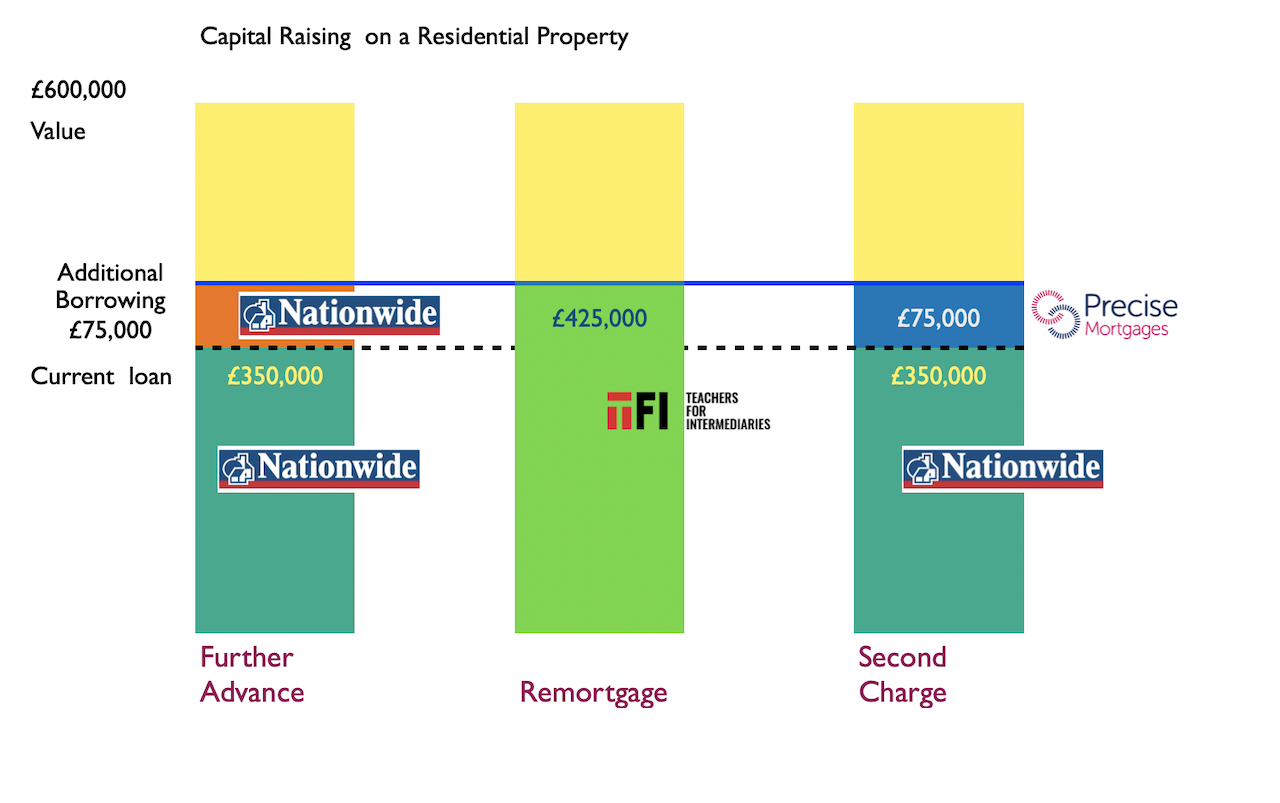

Remortgage, Further Advance or Second Charge. Three options to raise capital on your property.

Most Common “How” Google questions on Mortgages answered.

In this new series we try to answer the most common questions on mortgages Googled by the public.

Later in the series we will cover “What”, “Where”, “When”, “Which” and “Why” questions.

The idea of these posts are to provide non-finance experts with guidelines, so they can make informed decisions regarding property finance.

Series A: “How” questions on remortgages.

How – Question 2.

For todays’ “How” on Google, we will shed light on the ways additional money is freed on a property. There are several common “how” questions on the topic, looking for the same answer.

How to remortgage to release equity?

How can I raise more money on my property?

How do I get a second charge loan?

In the previous question about rate change we addressed one meaning of the term remortgage. For most of the public, a remortgage is same as a product switch as they achieve the same result. Similarly, when it comes to releasing equity in a property, remortgage for additional capital can have the same meaning to the layman as it produces the same outcome, but to a professional it can be three different processes.

- Raising capital on outstanding equity with the same lender is called a further advance.

- Changing lender and increasing the loan at the same time to free up equity from the property is called a remortgage.

- Staying with the current lender, but raising capital with a different lender is called a second charge.

In general these conditions apply to both residential and buy to let property. This does not cover Equity Release type / Lifetime Mortgages for over 55s.

There are many reasons people raise additional funds from their property. These could be for home improvements, repaying debt or even investing in another property.

Why would you use one option over another?

This comes down to several factors.

- Type of existing mortgage.

- Fees

- Penalties

- Income multiples

- Property value.

- Rental assessment (BTL).

1. Further Advance.

This is when you ask the existing lender to increase the mortgage and lend you more money based on the equity on the property.

Let’s say you are in the middle of a special rate period, such as a fixed rate for 5 years. It is likely there will a penalty (redemption) to move the mortgage to a different lender. So the first call is to ask the existing lender for additional money.

Disadvantages

- the current lender may not do a new valuation, instead rely on an average house price indexation calculation to determine the value. So it might not reflect a true increase in market value – which can lower the additional funding available.

- Maximum can also be restricted to lender’s income multiples or rental assessment (BTL). These might be lower than someone else’s.

- lender’s appetite for lending. They may not want to increase their risk on the property/applicant.

- the further advance is treated as a new loan and will go on a new rate. This might not be market leading.

- unlikely to agree a further advance if credit status has deteriorated.

Advantages

- low fees: low application fee or the fee is based on additional borrowing only and may not require a new valuation fees.

- lender has your history of payment.

- no redemption penalty.

- quickest option when capita raising.

2. Remortgage to a different lender.

If the existing lender refuse to give the required funding, the next option is to move the mortgage to new lender. Changing the lender will be treated as a new mortgage application.

Disadvantages

- if the current mortgage is in the middle of a special rate e.g. fixed rate, discounted rate etc, there is likely to be penalties to leave to another lender. In general the penalties are a percentage (%) of the loan in descending order. On a 5 year rate this could be 5%, 4%, 3%, 2%, 1% or 3%, 2%, 1% on a 3 year rate. Therefore the cost of moving can be too high in the middle of the special rate.

- there can be other fees, application fee, solicitor fee. Although most high street lenders these days offer free valuations and possibly legal costs on a remortgage.

- you will be credit scored and your financial status assessed by the new lender. If your credit status has declined since the current mortgage, you may not get a comparable beneficial rate.

- takes longer as it is a new application and needs to go through the legal process.

Advantages

- your property will be appraised new, consequently the loan can be based on the latest market value.

- the new lender might provide higher loan to income (LTI) multiples allowing you to borrow more.

- the whole loan can go on a single beneficial rate. Compared to additional borrowing through a further advance. Which is treated as an add-on loan and have a different rate (likely higher) to the main loan.

- your income may have increased allowing increased borrowing limits.

Lenders for illustration purposes only. Other suitable lenders also available.

3. Second charge mortgages

If the penalty on an existing mortgage is too prohibitive to remortgage and the existing lender is unable to provide the required additional funding, the option is to obtain a top-up loan from a different lender. This is still secured on the property, i.e. a second charge. Meaning this lender is second in line to recover their monies if the property is to be repossessed.

Important: the lenders that provide second charge loans tends to be specialist financial institutions. The average high street lender does not provide second charge lending.

Disadvantages

- fees plays a major role, when it comes to deciding if a second charge is the best option. It is important you identify all the potential fees before going ahead with an application. There can be a huge variation in the fees charged by different brokers. Some can charge 10% – 15% of the loan amount. Best is to keep away from those type of brokers.

- Second charge loans tend to have a higher rate. Partly due to most people using second charges when they are unable to obtain a further advance from the existing lender. This allow specialist lenders to charge a higher fee.

- LTV restrictions may also apply and can limit the total amount that can be borrowed.

- A 2nd charge loan also require consent from the first charge lender. If you have fallen in to arrears on the main loan or had missed payments, the main lender can refuse consent for another lender to put a charge on the property.

Advantages

- lending can be more flexible. Second charge lenders tend to use higher income multiple and are more generous in taking in to account all types of income, such as non-guaranteed or regular income. Therefore can lend more.

- allows to retain the existing main loan without loosing a beneficial rate or paying an Early Redemption Penalty to remortgage.

- greater flexibility for the reasons allowable for raising capital. Some primary lenders can restrict the reasons for additional funds.

- can allow some adverse credit.

Check out our decision tree on options at time of rate change.

Criteria that affects your borrowing level.

If you like our posts and find them useful why not join our twitter so you will not miss any future post and mortgage related news. Join us at @axess_fs