Affordability and maximum loan -how debt to income ratio and credit score affects income multiples.

Credit File for £2 – get credit file for £2 without monthly fees

Mortgages for LTD company Directors – how salary, dividends and net profit used in max loan.

On the Market – portal that allows agents to have greater control of propety listings.

Nestoria – aggregation from other property portals.

Nethouseprices – Past sale prices and estimated current values.

Prime Location – site run by zoopla.

PurpleBricks– online property portal with local agents.

Right move – largest property portal in UK.

Residential People – free to list portal.

SmartNewHomes – another site bought by zoopla, but dedicated to new builds only.

Tepilo – site set up by TV presenter Sarah Beeny selling for a fixed price. May not give an advantage of less competition as the site says same properties will be promoted through RightMove and Zoopla.

Zoopla – Portal from a large conglomerate that owns many financial sites – potential duplicates with other big sites.

HMRC Stamp duty calculator

Monthly Payment Calculator (downloadable excel format)

Early repayment penalty

As with all mortgages and loans lenders borrow money from the money markets and lend to the public at a margin. The loans are structured depending on the expected term. Later life lending loans are designed to last for a long perid. Therefore early repayment of the loan will elicit a penalty. Early repayment will require the lender to find an alternative customer for that loan. Therefore the ERP is to discourage as well as to recover the cost of find an alternative home for the funds.

Types of Early Repayment Penalties

1. Fixed

Based on a percentage of the outstanding loan. Usually applied up to 10 years from the start on a decreasing process. However, not all lenders apply the fixed penalty in the same way.

Case study: Mr & Mrs Jones takes a lifetime mortgage of 125,000 . Mr Jones is age 72 and his wife is age 65. They elect to service the interest on the loan, so interest is not capitalised and the amount remain same.

They want to redeem the mortgage in the 6th year. The ERC applied after 5 years is 5% (there is no ERC after 10 years).

Example 1: Lender A – Penalty 8% year 1-3; then 7%,6%,5%,4%,3%,2%,1%.

Amount to repay (above penalty free amount) including all charges and interest.

x

ERC applied at time of redemption.

(Subject to lender)

=

Redemption penalty

Redemption penalty

Amount to repay (above penalty free amount) including all charges and interest.

Redemption penalty

The loan amount – penalty free amount plus fees outstanding.

125000 -12500 + 2500 = £115,000

x

ERC is for 10 years. After 5 years ERC is 5%.

=

Redemption penalty

£115,000

x

5%.

=

£5,750

Example 2: Lender B – Penalty is 5% for year 1-5 ; 3% year 6-10.

The loan amount – penalty free amount plus fees outstanding.

125000 -12500 + 2500 = £115,000

x

ERC is for 10 years. After 5 years ERC is 3%.

=

Redemption penalty

£115,000

x

3%.

=

£3,450

Example 3: Mr and Mrs Jones decides to redeem the loan after 8 years as they both need to go to long term care. It is a condition of all lifetime mortgages that there will be no penalty if the applicants go to long term care.

The loan amount – penalty free amount plus fees outstanding.

125000 -12500 + 2500 = £115,000

x

ERC is for 10 years. However as redemption is due to long term care the penalty is 0%.

=

Redemption penalty

£115,000

x

0%.

=

£0

1. Variable

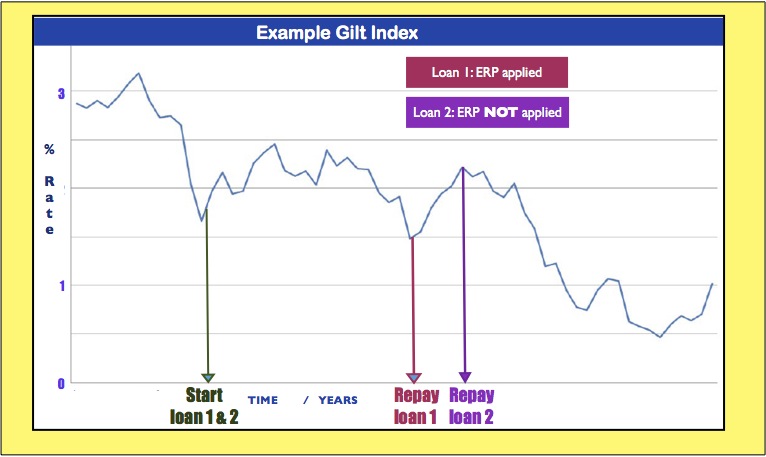

Movement of a selected benchmark gilt or bond index, e.g. UK gov treasury 20 year gilt index.

Other benchmarks commonly used include:

- UK treasury 15 year gilt index.

- 25 year swap rates – The 25 year swap rate is the rate quoted in the money markets for borrowing funds at a fixed rate of interest over 25 years.

(All are quoted daily in FT)

Three factors are taken in to account to calculate the penalty.

- The difference between the rate of the selected index at the start and the index at the time of your request to repay.

- The time left until the end of the ERP penalty period. This penalty period is applied to a certain age of the applicants (age of the youngest applicant- if joint), e.g. to age 88. This is an important criteria. Different lenders have different penalty periods. It is very important to pay attention to the rules used here. [if not clear ask your adviser to explain further].

- The balance of the mortgage on the date to be repaid. This balance will include all interest and charges.

Case study: We will again use Mrs & Mrs Jones to illustrate how variable ERPs work; both when the index has fallen as well as risen.

Mr & Mrs Jones takes a lifetime mortgage of 125,000 . They elect to service the interest on the loan, so interest is not capitalised and the amount remain same.

They want to redeem the mortgage in the 10th year. The ERC is applied by the lender until the 85th year of the sole/ youngest applicant.

Example 1: Loan 1 – At the start of the loan the index is 1.75% (Graph above). When the loan is redeemed the index is 1.5%

Example with Index falling – LOAN 1

The loan amount – penalty free amount plus fees outstanding.

125000 -12500 + 2500 = £115,000

x

ERC is to age 88. Age of youngest at time of redemption 75. Term for penalty = 88 – 75

x

Difference in Index at start and redemption = 1.75 – 1.5 = 0.5%

=

Redemption

penalty

£115,000

x

10

x

0.5%

=

£5750

Example with Index rising – LOAN 2.

The loan amount – penalty free amount plus fees outstanding.

125000 -12500 + 2500 = £115,000

x

ERC is to age 88. Age of youngest at time of redemption 75. Term for penalty = 88 – 75

x

Index at start 1.75. Index at redemption 2.25%. Therefore there is no redemption penalty.

=

Redemption

penalty

£115,000

x

10

x

0%

=

£0

Important considerations for variable rate: economy

Three main types

1. Family Deposit Account

Members of the family provides a security deposit (up to 20%) which is returned once the value of the property increases or sold. The deposit earns interest.

Lender provides 95% loan for purchase. Applicant provides 5% deposit.

2. Family Offset Account

Family holds up to 20% of deposit in an offset account on their own name. No interest is earned in the offset account.

Lender provides 95% of loan and applicant 5%. Interest is charged on 75% of the loan only, so gaining a saving on payments.

3. Family home as security

Lender takes a charge on parent’s / family member’s home and provide 100% loan for purchase.

Affordability based on applicant’s income. Applicant provides no deposit.

Example of a guarantor scheme: Family Offset Mortgage

Joint Borrower Sole Occupier

Is another type of family assisted mortgage. Where the surplus income of a parent/step parent can be used to boost the income multiples of the applicant. All secured (mortgage) and unsecured (credit) outgoing of the parent will be taken in to account for affordability.

- Only the occupier of the property will be named on the deeds. However, the parent/ family member will be party to the mortgage with joint and several liability for the debt. Some lenders will only allow close family members, e.g. parents, step-parents, siblings, while others will allow unconnected parties. All will be credit scored and credit assessed.

- As only one name on the deeds, there is no additional second home stamp duty charge for the supporter.

- Residential owner occupier mortgages only and up to 95% LTV. Loan can only be capital repayment basis.

- Affordability 4.5x to 5x joint income. Annualised outgoings for both applicants (e.g. mortgages, credit cards, loans, HP etc) will be deducted from income before applying multiples. The JBSO mortgage will be treated as an outgoing for the supporter for any credit assessment in the future.

- Minimum age 18. Maximum 2 applicants. No BTL property allowed.

- Both applicants must have taxable income, e.g. employed, self employed, pension.

- The supporter can be removed from the mortgage once the occupier’s income become sufficient to support the mortgage independently.

- Parent/ family members must take independent legal advice regarding their party to the debt.

Help to Buy

Currently there is only one type of Help to Buy (H2B) scheme available, the Help to Buy Equity Loan Scheme, You require a deposit of at least 5%. The government then provides you with an Equity Loan of up to 20% in England excluding London, 40% in London and 15% in Scotland. Only available for new build home property. The government loan is interest free for the first 5 years. After 5 years you will have to pay the interest on the Equity Loan (except in Scotland).

The scheme is open both to first-time buyers and home movers purchasing a new-build property or remortgaging with a maximum purchase price of up to £600,000, from a registered developer.

The scheme is administered by Local HomeBuy Agents who assess and approve all applications.

New build property only – can be more expensive than pre-owned, have to rely on many intermediaries e.g. builder, help to buy adminisitrators, lender, selling agent.

Loose up to 20% future property price rises.

Cannot make any alterations to the property without permission from H2B scheme managers.

Sale price must acceptable to scheme provider (selling under value to family member etc not allowed).

Not available if there is adverse credit.

Help to Buy- Mortgage guarantee.

- You contribute: 5% of purchase price.

- Governmant provides you a loan: up to 20% of purchase price

- Mortgage Lender provides rest e.g. up to 75% outside London and 55% in London.

- Must use a registered Help to Buy agent (H2B) and the property needs to come from a H2B registered builder.

Pros

- Minimal deposit of only 5% to enter the property ladder.

- No interest payments in the first 5 years- so a very efficient way to borrow money.

- Low interest for a period after 5 years

- Option to pay off total loan (based on property value at time) at any time and own outright. Minimum repayment is 10% of market value.

Cons

- New build property is similar to buying a brand new car. You might like the idea of you are the first owner, but same as cars they are overpriced or has a new build premium. You are not likely to see any rise in value of the property in the next few years. It might even be worth less in the first 2 years. New build premium could be 10% – 20% of value.

- Rates are higher than for similar residential mortgages.

- Not available as guarantor mortgages, maximum lending is still limited to income earned. Lower income multiples than standard mortgages.

- Not all lenders lend to H2B so not all deals are available.

- Property cannot be let and you are not allowed to own any other property at same time.

- Not available if there is adverse credit i.e. over 3 month’s missed payment in the last 3 years, CCJs over £500 or bankruptcy within last three years.