For todays’ “How” on Google, we will shed light on what affects the amount you can borrow on a mortgage.

Most Common “How” Google questions on Mortgages answered.

In this new series we try to answer the most common questions on mortgages Googled by the public.

Later in the series we will cover “What”, “Where”, “When”, “Which” and “Why” questions.

The idea of these posts are to provide non-finance experts with guidelines, so they can make informed decisions regarding property finance.

Series A: “How” questions.

Question 3 : how many multiples of income can I get for a mortgage?

In the old days of less regulation, it was a simple calculation based on income multiples that lenders used to decide how much to lend to a particular customer. Fixed and committed outgoings were not strictly factored in to income multiples. There was even, what was called self certified mortgages, where applicants were allowed to declare their own income in-return for a larger deposit.

After the market crash at the end of the last decade, the financial regulators instigated stronger checks on affordability for mortgage lending. Fall in property prices and jobs left many homeowners unable to pay their mortgage, leading to increased repossessions, while making some owners mortgage prisoners due to negative equity and inability to remortgage.

To prevent such issues lenders are requested to strictly check affordability levels for all residential mortgage and somewhat for buy to let mortgages (although part is sustained by the rent) these days.

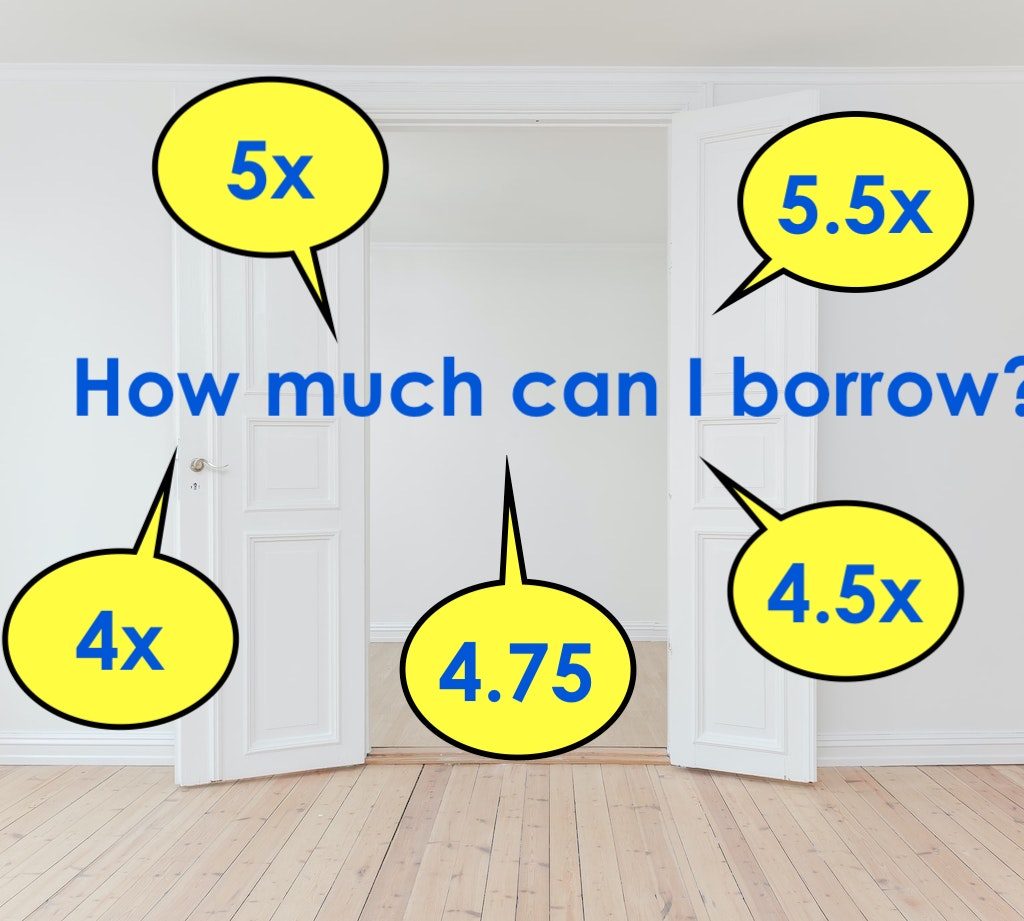

So how much can you borrow. Lenders use numerous criteria to assess affordability. It is still roughly based on income multiples. Lenders won’t admit it, but there is a ceiling. For example, you won’t be able to borrow 10x income irrespective of how much you earn. However, the calculation is more nuanced and multiples are graduated. So it is not easy to establish until a decision is obtained. Lender will also tweak this based on market conditions.

If you fulfil all the requirement you get the highest multiple. If not, it’s reduced.

Nine factors that will determine your loan amount.

- Credit profile and not the score. How credit is conducted is more important than the score. Not having adverse credit such as late payments, defaults, county court judgements etc, will give the highest multiples. How long ago the judgement resulted also affects the score; as well as if it is satisfied at application. Lenders that lend to adverse credit tend to only give 3.5 – 4.25x income. [Low credit score is not always a reflection of credit status as it may be due to lack of credit rather than poor credit conduct].

- Monthly outgoings. If you have high levels of fixed expenditure such as loans, credit cards, travel costs etc, there is an impact on the maximum loan.

Outgoings that cannot be avoided are annualised and deducted from the income before income multiples. For example, if you pay £100 per month for a loan, the annual income will be reduced by £1,200 (100×12) before multiples.

Outgoings are not just deducted from income. The amount compared to total income also matter. It is called the Debt to income ratio or DTI.

- Level of income. Higher the income higher the income multiples. Some lenders will give 4.75x income as standard, however, if the income is above £60,000 it can be 5x and over £80,000 even 5.5x. Specialist lenders can provide 5x income even at a lower income, subject to credit profile, but at a higher rate.

- Financial dependants – bigger the family lower the level of lending. Costs of childcare and school fees can be taken in to account.

- Type of job or job security. Employment deemed to be secure are preferred for lending. So ‘professions’ such as Drs, Solicitors, Teachers can have a higher multiple.

There are special considerations for IT contractors, where the calculation is based on day rate rather than tax returns.

Company Directors with over 20% shareholding have two options to maximise their borrowing. Some lenders will use salary + dividends to calculate the loan, whilst other lenders can use salary + net profit after corporation tax. - Kind of contract – permanent, non-guaranteed regular or zero hour. If the income is shown to be consistent, even if it is zero hours, some lenders will consider it. Full or part time and the number of hours worked also impact. If the job or (combinations of) jobs involve too many hours, it is considered unsustainable and a higher risk in the long term.

- Level of deposit – self evident. Higher the deposit less risk to lender. Some high street lenders will advance 4.75x up to 85% LTV, but only 4.5x above this. Larger deposit is not only good for higher multiples, but also give a better rate.

- Rate tie-in period – a longer fixed rate period gives lender more security on affordability. So higher lending for fixed rates of 5 years or more.

- Age – shorter the time to retirement, lower the multiple. When you are paying capital and interest, shorter the time to repay, higher the monthly payment needs to be. So less affordability.

The reverse is, the maximum loan can be increased by choosing a longer payment period. Lenders can allow 35 – 40 years term. Term must end before retirement.

If you like our posts and find them useful why not join our twitter so you will not miss any future post and mortgage related news. Join us at @axess_fs

Latest News

If you wish to know more, call us for a free discussion.