Homemovers & Let to Buy

Affordability and maximum loan -how debt to income ratio and credit score affects income multiples.

Credit File for £2 – get credit file for £2 without monthly fees

Mortgages for LTD company Directors – how salary, dividends and net profit used in max loan.

On the Market – portal that allows agents to have greater control of propety listings.

Nestoria – aggregation from other property portals.

Nethouseprices – Past sale prices and estimated current values.

Prime Location – site run by zoopla.

PurpleBricks– online property portal with local agents.

Right move – largest property portal in UK.

Residential People – free to list portal.

SmartNewHomes – another site bought by zoopla, but dedicated to new builds only.

Tepilo – site set up by TV presenter Sarah Beeny selling for a fixed price. May not give an advantage of less competition as the site says same properties will be promoted through RightMove and Zoopla.

Zoopla – Portal from a large conglomerate that owns many financial sites – potential duplicates with other big sites.

HMRC Stamp duty calculator

Monthly Payment Calculator (downloadable excel format)

Moving home to larger property / down sizing / letting to buy.

Options when moving home:

- Sell current property and use equity as the deposit.

- Move current mortgage to new property – with further borrowing.

- Retain current property and rent out – will require transferring mortgage to Buy to Let.

- Retain current property and capital raise for the deposit.

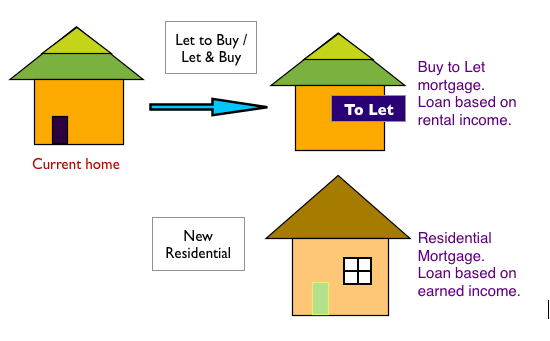

LET TO BUY:

Letting the current property whilst moving to a new home. There are several rules applying to this situation and it varies from lender to lender – see below.

Rules for letting to buy:

1. Not all lenders allow let to buy property.

2. The property to be let needs to be transferred to a Buy to Let mortgage. Letting a property on a residential mortgage is not allowed. Often clients will want to let the property on an existing residential rate for obvious benefit of a low rate on a residential mortgage. A buy to let mortgage rate is usually higher than a comparable residential rate. Instead of changing to a buy to let mortgage, the new lender can often accept written confirmation from existing lender giving permission to let the property.

3. Some lenders require new purchase to be transacted at the same time, i.e. transferring existing property to a buy to let is not allowed unless the new home purchase is done at same time.

4. Rent for existing property must cover mortgage at a certain amount above the mortgage payment. Can vary from lender to lender. See BTL rental calculation. If so the let property mortgage will be not taken in to account for affordability of the new loan.

5. Warning: Buying a property as a buy to let and moving to live in it is considered as fraud by the lenders. This is a scenario looked at by some clients when there is not sufficient income to obtain a loan to buy a larger home. Lenders regularly check to ensure that the client is not living at the buy to let house.

Lender checks for a Let to Buy:

- at application stage checks will be made to identify possible misuse of LTB//BTL. For example, correspondence/security address checking, plausibility checks on the borrower and type of property (such as where the customer renting a property larger than their main residence)

- checks will be carried out post-completion. For example, checking of credit files, the electoral roll and correspondence/security addresses

- no advance on a LTB remortgage without evidence of a new residential offer

- further information will be sought if the underwriter has any concerns over the LTB/BTL arrangement.

Some lenders can put a notification on a credit file under CIFAS or fraud register if a Let to Buy or a Buy to Let mortgage is mis-used, which will cause an applicant immense difficulties in future.

Case study 1 – Homemover with sale of current property

Case study: Mr & Mrs Jones.

With a growing family Jones’ are looking to move from their two bedroom property to a four bedroom house with a garden.

Current property: value £230,000; mortgage £150,000 with Nationwide; rate 1.99% fixed.

New property: value £350,000.

Mr Jones salary : £32,000; Mrs Jones salary : £24,000. They have no large savings.

Maximum loan available: £280,000.

In this situation Mr & Mrs Jones decides to sell their current property and use the £80,000 profit towards the deposit for the new property. They also want to maintain their current low rate. As the existing mortgage is a portable mortgage, the current lender agrees to transfer the loan to the new property without a penalty; as well as lending them the shortfall at the same rate.

Case study 2 – Let & Buy with retaining the current property

Miss Arias owns a 1 bedroom flat with a market value of £200,000 with an outstanding mortgage of £60,000.

Due to her new job in a major town she wishes to move to a new property valued at £350,000 near her work.

Current mortgage is with Coventry BS ; rate 1.69% fixed.

New property: value £350,000.

She would also like to retain the current property as an investment and rent it. She hopes it would be a long term investment for her retirement.

Miss Arias’ salary : £52,000.

She has savings of £25,000

Maximum loan available based on income for the residential: £260,000.

Maximum loan available based on rent for the BTL property: £132,000.

In this situation Miss Arias need £65,000 to complete the purchase. She decides to transfer/remortgage the current property to a BTL mortgage and raise additional £65,000 at a LTV of 75%. As the existing mortgage is portable, the current lender agrees to transfer the loan to the new property without a penalty. However, the BTL lender will only allow the current property to be transferred to a BTL mortgage if the current mortgage is transferred to a new property at the same time.

Buy to Let mortgages – loan is based on rental income.

Residential Mortgages – loan is based on earned income.